Previous post

March 13, 2023

It has not been a good weekend in the banking world. But never fear! Here comes Joe Biden to… give a speech on protecting “our historic economic recovery.” Oh, well, don’t you feel better now?

The collapse of Silicon Valley Bank, which Nina covered the background of here, is a massive problem for Democrats. Biden is going to be staking his entire (potential) re-election bid on the “stablization” of the economy (never mind that pesky inflation that has blown a hole in the average American’s budget). Which means that he has to try to stop the bleeding on the markets’ reaction to Silicon Valley Bank’s closure – and the closure on Sunday of yet another bank, on the other side of the country.

And this is where things will get reaaaaaaallly uncomfortable for Democrats. Guess who was sitting on the board of Signature Bank? A blast from the political past.

Former Rep. Barney Frank (D-MA) endorsed changes to his own Dodd-Frank law in 2018 that freed mid-sized banks from undergoing stress tests. He sits on Signature Bank's board, which just collapsed.

I reached him via phone tonight and he declined to comment https://t.co/JY77rtNkHt

— Joseph Zeballos-Roig (@josephzeballos) March 13, 2023

Oh look, it’s Barney Frank, co-author of the Dodd-Frank Act, which was supposed to keep things like this from happening. Of course, as the above highlighted Washington Post article from 2018 points out, Frank was all for rolling back the rules that he had once pushed – because now it benefited HIM.

But the proponents of the law rarely, if ever, mentioned that Frank is not just the author of the 2010 law, but also sits on the board of New York-based Signature Bank, a financial firm in position to benefit from the new legislation.”

“When citing Barney Frank as the historic creator of Dodd-Frank, it’s important to flag he may have different motivations now as the public gauges whether these rollbacks are good for them or good for Wall Street,” said Lisa Gilbert, vice president of legislative affairs at Public Citizen, a government ethics watchdog.”

The rollback passed the Senate in March and the House earlier this week, and President Trump signed it into law Thursday.”

Dodd-Frank imposed additional regulatory safeguards on banks with more than $50 billion in assets, but the rollback that passed this week, among other things, raises that threshold to $250 billion. Signature Bank has more than $40 billion in assets and can now grow significantly without automatically facing additional regulation. Frank has served on Signature’s board for three years and has received more than $1 million in payments from the bank during that time.”

In an interview, Frank acknowledged that Signature stood to benefit, but he said his role on the bank’s board did not influence his thinking.”

And now Signature Bank has gone belly up, and Democrats are faced with the uncomfortable spectacle of seeing Barney Frank being dragged back into the conversation. What happened to Signature Bank? Cryptocurrency, apparently.

Founded in 2001, the New York-based Signature Bank was popular among crypto companies. The institution provided deposit services for its clients’ digital assets but did not make loans collateralized by them.”

Leading up to SVB’s collapse, the bank said it had been trying to reduce these deposits. As recently as Thursday, Signature said it was in a “well-diversified financial position” and had “limited digital-asset related deposit balances in the wake of industry developments.”

“We want to make it clear again that Signature Bank is a well-diversified, full-service commercial bank with more than two decades of history and solid performance serving middle market businesses,” Joseph J. DePaolo, Signature Bank Co-founder and Chief Executive Officer said in a statement.”

So, how does Joe Biden attempt to put a band-aid on this one? Well, how does a politician fix anything? Give a speech, of course!

Over the weekend, and at my direction, the Treasury Secretary and my National Economic Council Director worked diligently with the banking regulators to address problems at Silicon Valley Bank and Signature Bank. I am pleased that they reached a prompt solution that protects American workers and small businesses, and keeps our financial system safe. The solution also ensures that taxpayer dollars are not put at risk.”

The American people and American businesses can have confidence that their bank deposits will be there when they need them.”

I am firmly committed to holding those responsible for this mess fully accountable and to continuing our efforts to strengthen oversight and regulation of larger banks so that we are not in this position again.”

Tomorrow morning, I will deliver remarks on how we will maintain a resilient banking system to protect our historic economic recovery.”

Well, the Biden administration might be showing up a little too late to fix anything. The auction of Silicon Valley Bank was started this weekend by the FDIC, with bids closing on Sunday evening. However, by Sunday night, there was no announcement that anyone had “won” – and there was confirmation that at least one bid had come in from the Bank of London. Will Biden announce who “won” in today’s speech, in an attempt to make it look like things are under control? How long do you think it will be before someone starts blaming Donald Trump for signing the rollback of Dodd-Frank Act rules that Barney Frank himself wanted? There will be blame-shifting incoming, and as Glenn Reynolds pointed out on Instapundit, the people of East Palestine, Ohio, had to wait weeks before federal help showed up, but Silicon Valley Bank and Signature Bank depositors will have access to their money after a single weekend, and anyone who points out motive must be “cynical.” *snort*

Today’s speech by Biden is likely to attempt to reassure investors that everyone’s going to have access to their money this morning, as the Treasury Department and the FDIC announced on Sunday, using a new “Bank Term Funding Program” to provide the money. Will that be enough to stop a full-blown financial panic? How are the markets going to react once they open? And how are Democrats going to react?

Just got off of a zoom meeting with Fed, Treasury, FDIC, House, and Senate.

A Democrat Senator essentially asked whether there was a program in place to censor information on social media that could lead to a run on the banks.

— Thomas Massie (@RepThomasMassie) March 13, 2023

Oh, great. With that attitude, what could possibly go wrong?

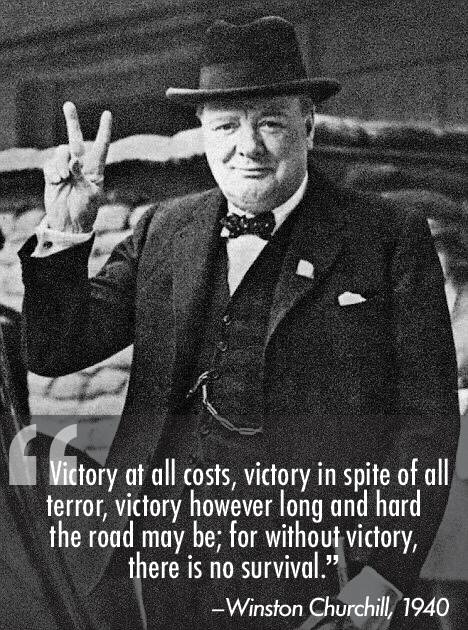

Featured image: original Victory Girls art by Darleen Click

Install a Costanza-Backstop. On important matters, whatever Joes Biden decides and publicly states the actionable remedies he will take, the machinery of government will do the opposite.

Tip Us!

Become a Victory Girl!

Follow Us On Twitter!

Recent Comments

Rovin’ Redhead

1 Comment